Crafting Global Mobility Reward Strategies for Expatriates and International Assignees

2024-04-03

The role of Global Mobility is critical in ensuring smooth transitions for employees moving abroad, encompassing policy development, assignment coordination, compliance, support, and cultural integration. Hasty and inconsistent reward strategies for international assignments can lead to high turnover and dissatisfaction. We discuss the different reward approaches—international assignment package build-up, salary purchasing power parity, cost of living allowance, and local market approaches—underscoring the importance of a well-defined global mobility reward strategy aligned with organizational objectives to ensure fair and motivating compensation for globally mobile employees.

What is the difference between an expatriate, an international assignee, or a global nomad?

The term "expat" (short for "expatriate") is widely used to describe someone who lives outside their native country. However, discussions around the term's use have highlighted that it can sometimes carry connotations of privilege, class, and even race, distinguishing certain groups of people living abroad from others, such as migrants or immigrants, in ways that can be perceived as unfair or biased.

A more neutral and politically correct term that is often used is international assignee. This term aims to avoid the connotations of privilege or status that "expat" might imply and focuses instead on the simple fact of being on a work assignment in a country different from one's country of origin typically for a defined period. Another term that is inclusive and avoids potential bias is "global nomad," which conveys a sense of mobility and choice without implying socioeconomic status or the expected duration of the stay.

In this article we focus on the reward for an international assignee moving to another country at the request of the organisation, often for a period of 1 to 5 years but including localisation relocation.

The Role of Global Mobility

Global Mobility involves all aspects of managing international relocation and assignment processes for employees within a company. The work involves a wide range of responsibilities designed to ensure a smooth transition for employees moving abroad for work, whether temporarily or permanently. Here's an overview of what a Global Mobility Specialist typically does:

- Policy Development and Implementation: They create, manage, and update the company's global mobility policies. This includes defining the types of assignments available, the benefits employees are entitled to while abroad, and the conditions under which they return to their home country or move to another location.

- Assignment Planning and Coordination: They coordinate all aspects of an employee's international assignment. This involves logistical arrangements such as visa procurement, housing, schooling for children, and language training. They also manage the financial aspects, including global mobility reward comprising either a full international assignment package, a salary purchasing power parity adjustment, or a cost-of-living allowance. In some cases, the assignee may be “localised” in alignment with the host country total remuneration market. Each of these approaches typically involve ensuring the reward is tailored to the assignees level and family status, as well as compensating for cost of living, hardship, tax and exchange rate differences. Addition financial aspects include relocation related benefits and expenses.

- Compliance Management: They ensure that all aspects of the international assignment comply with the laws and regulations of the home and host countries. This includes immigration, taxation, employment law, and social security.

- Vendor Management: They often work with external partners and service providers, such as relocation agencies, tax consultants, and legal advisors, to facilitate various aspects of the move and the assignment.

- Support and Counseling: They provide ongoing support to employees and their families before, during, and after the assignment. This includes answering questions, addressing concerns, and helping to resolve any issues that arise, ensuring the well-being of the assignees.

- Performance and Cost Management: They monitor the effectiveness of the global mobility program, assessing the performance of assignees and managing the costs associated with international assignments to ensure that the company's investment delivers the expected returns.

- Cross-Cultural and Integration Training: They may also provide or arrange for training that helps the employee and their family understand and adapt to the culture of the host country, aiming to reduce culture shock and improve their overall experience.

In essence, Global Mobility Specialists facilitate international work experiences that benefit both the employee and the organization, ensuring that operational needs are met while also supporting the personal and professional growth of the individual. Their role is complex and multifaceted, requiring a blend of skills in human resources, legal compliance, financial planning, and intercultural communication. Reward is therefore only one aspect of global mobility, but it is a complex multi-faceted discipline.

Global Mobility Reward Strategy

Many organisations spend insufficient time creating a well-designed global mobility reward strategy and policy for international assignments. This is dangerous given that the highest employee turnover is at the beginning and end of international assignments, indicating a lack of integration of global mobility reward philosophy with the broader organisational reward philosophy.

The reward of international assignees often tends to be a rushed last-minute decision due to urgent operational requirements. The resulting implications often only arise after the assignee arrives in the host country, and when the assignment comes to an end. For example, the post assignment position back in the home country pays less than the assignee earned on assignment.

Inconsistent treatment of international assignees quickly leads to unhappy employees and potentially their families. Once an organisation has more than 1 or 2 assignees in the field it becomes vital to have a defendable global mobility reward strategy in place. This strategy should clearly convey the organisation's reward principles regarding international assignments. A global mobility reward strategy is intended to provide guidance in the consistent and equitable treatment of all international assignees and forms the basis of the organisation's global mobility reward policy and process for individual assignments.

Most large global organisations have over time established a clear policy for rewarding international assignees. This is often a legacy policy, where past practice has become policy. However global mobility reward is a complex area of reward with complex issues such as volatile exchange rates, weak and strong currencies, constantly changing differences in cost of living between countries, different tax regimes, as well as the reality that there are attractive and not so attractive countries to work and live in. This is an area where a clear strategy and an aligned practical policy and transparent process are required to ensure attraction, fairness, equity, motivation, and retention.

There are as many different global mobility reward practices as there are organisations with international assignees. However, we can identify at least four broad approaches to international assignment reward that have emerged as the dominant strategies underlying global mobility reward.

International Assignment Package Build-Up

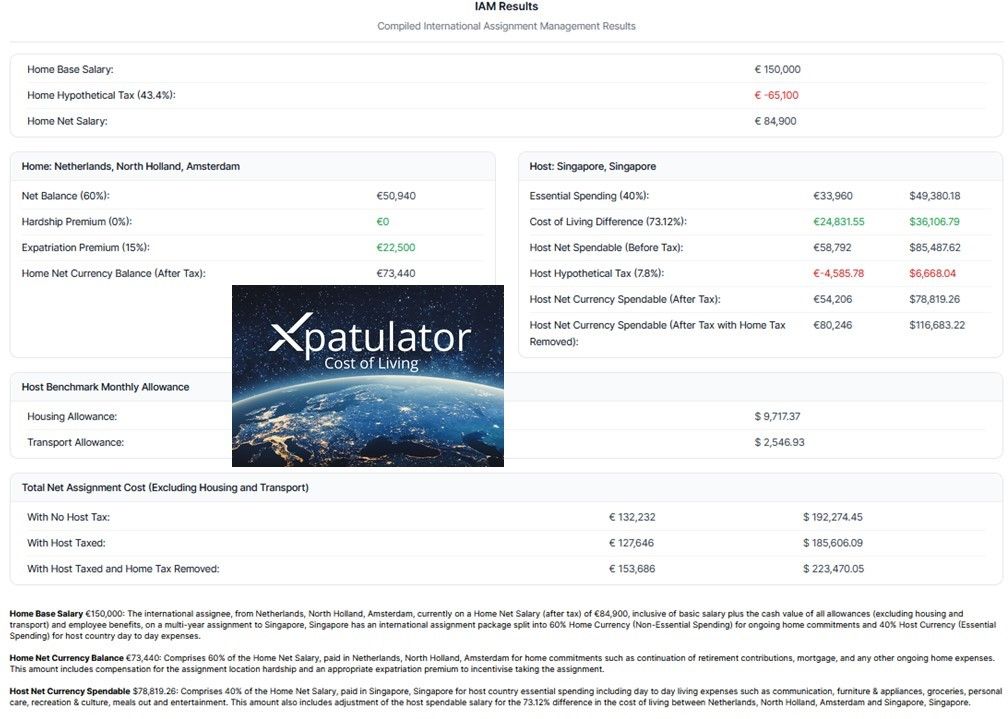

The international assignment package build-up approach uses the current market related home salary as the base for calculating international assignment package. Home in this case is the country where the employee permanently resides or is a citizen. The purpose of the build-up approach is to maintain internal equity between countries and to equalise the impact of differences between country tax rates. This ensures that assignees neither lose nor gain as a result of tax treatment in the host country.

The international assignment package build-up approach typically involves deducting hypothetical tax in the home country, and builds on top of the home salary with an international premium (to compensate for the hardship / inconvenience experienced), cost living index (to compensate for cost of living differences) and the exchange rate to calculate a total net (i.e. after tax) assignment package. The assignment package is typically split into Home Currency (Non-Essential Spending) for ongoing home commitments and 40% Host Currency (Essential Spending) for host country day to day living expenses.

The host net element is then "grossed up" in the host country for local tax and other statutory and non-statutory deductions to ensure the host net spendable (after tax equalisation) is paid to the assignee.

Salary Purchasing Power Parity (SPPP)

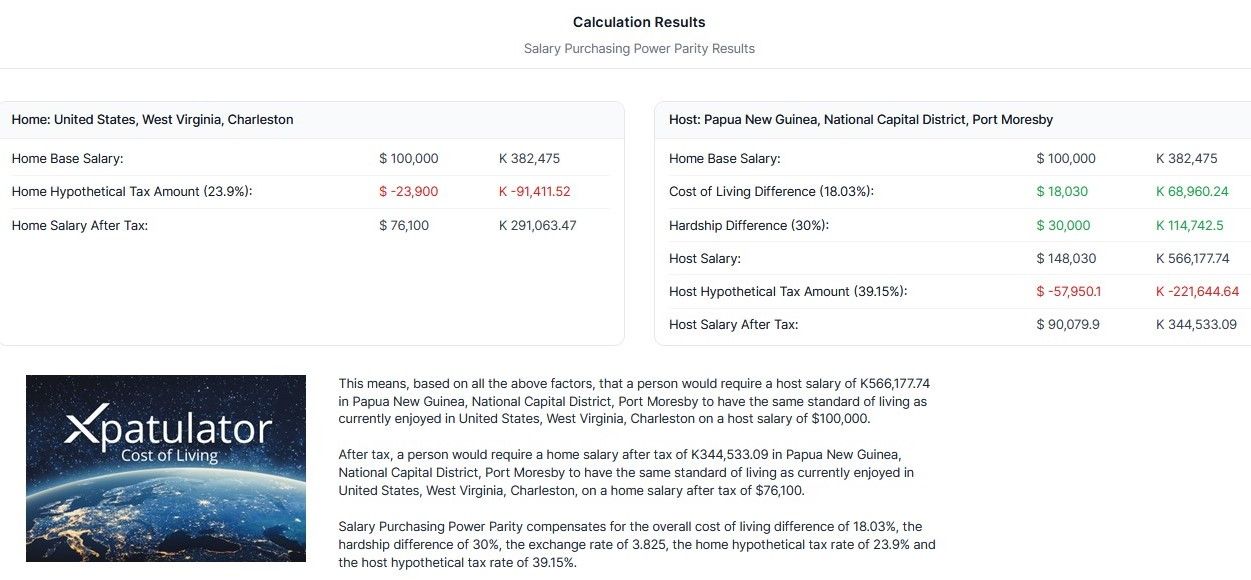

The Salary Purchasing Power Parity approach uses the principle of putting all employees within the organisation on an equal footing regardless of nationality and geographical location. The purpose of the SPPP approach is to ensure parity in the level of the purchasing power of the salary of employees doing the same work, at the same level, in different parts of the world, taking hardship, cost of living, and exchange rate differences into account.

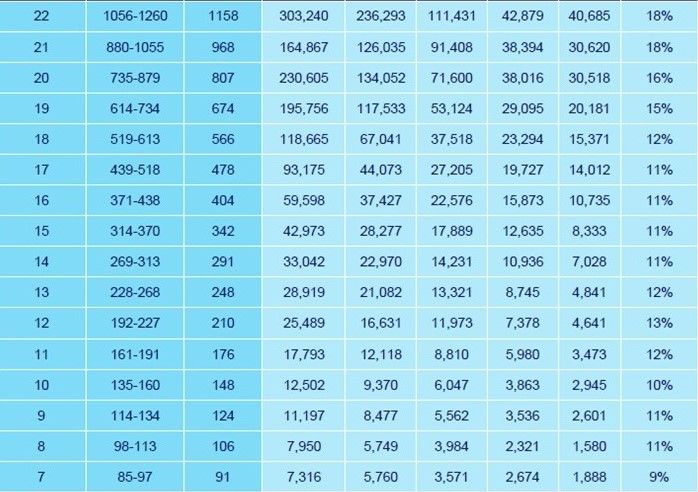

This approach is typically used by global organisations that have a large number of global employees, who move from one international assignment to another and compete globally for skills. Organisations using the SPPP approach typically establish a single global pay scale which is often by default that of the global headquarters country. The expatriate's salary is calculated by adding calculated additional amounts for the hardship, cost of living, and exchange rate differential between the global headquarters (home) and the host country.

The assignment package is then taxed in the host country and other statutory and non-statutory deductions made to arrive at the net pay assignment package paid to the employee.

Cost of Living Allowance (COLA)

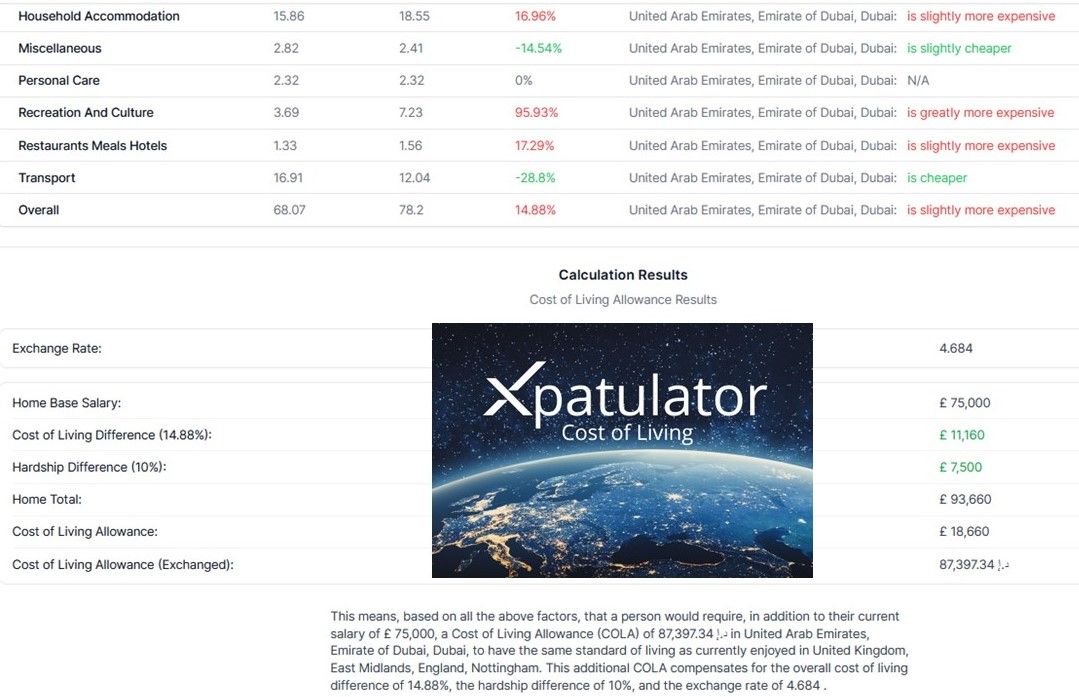

The Cost-of-Living Allowance approach uses the principle of retaining the employee's home salary and paying an additional separate allowance, primarily for cost of living, but also for hardship based on the differences between the home location and the host location. The purpose of the COLA is to ensure parity in the level of the purchasing power of employees doing the same job at the same level in different parts of the world, taking hardship, cost of living, and exchange rate differences into account by paying a cost of allowance to compensate for the differences. This approach is used mostly for short term assignments of 3 months to one year. At the end of the assignment the COLA falls away.

This approach is typically used by international organisations that have many employees who regularly move from one short-term international assignment to another and compete globally for skills. Organisations using the COLA approach typically have country level pay scales. The expatriate's COLA is calculated by adding calculated additional amounts for the hardship, cost of living, and exchange rate differential between the home country and the host country.

The assignment package is then taxed in the host country and other statutory and non-statutory deductions made to arrive at the net pay assignment package paid to the employee.

Local Market (LM)

The Local Market approach uses the principle of applying the local (i.e. host country) market Base Salary and Total Reward pay rates. In many organisations the policy is to use the better of the Build-Up or the Local Market approaches, to ensure that the assignment package is equitable and competitive in the host market.

Due to the need for market data, the Local Market approach is typically only used where a strong local market exists in the host country, and reliable salary surveys exist that accurately report the level of market salary for different positions. For example, take an organisation sending an expatriate from an economically poor, relatively low paying (when converted to USD) salary market country to a city such as New York. It is likely that having used the home base salary as the basis of the calculation, that the resulting total assignment package will be significantly lower than the New York Salary Market, which is a high paying area within the USA. This would occur even after adding an international premium (to compensate for hardship experienced), and a cost living amount (to compensate for the higher cost of living in New York) as well as applying the exchange rate. Where the Build-Up approach is lower than the Local Market, best practice is to adopt the local market approach or risk losing the employee within the local (host) market. It is important to communicate to the employee that the local market is only for the duration of the assignment and is related to the host country cost of living. The local market approach is typically used in high economic growth and high cost of living countries where demand for skills is high and there are many international employees comprising many nationalities such as in the United Arab Emirates, Hong Kong, Singapore, Shanghai, London or New York.

Conclusion

It is important to ask questions about your current global mobility reward strategy. Does your current global mobility reward strategy drive the desired behaviour? Is the current policy and practice aligned to organisational objectives? Does the current policy work for or against the organisation achieving its global objectives? Is the assignment package attractive enough to encourage employees to take up assignments and importantly, can they be returned to the home country at the end of the assignment without experiencing a drop in purchasing power. We recommend a regular review of organisational global mobility reward considering what the organisation seeks to achieve and where it operates geographically, whilst ensuring integration with the other reward related strategies of the organisation.