The Cost of Living: Asia-Pacific’s Most Expensive Cities in 2025

2025-10-01

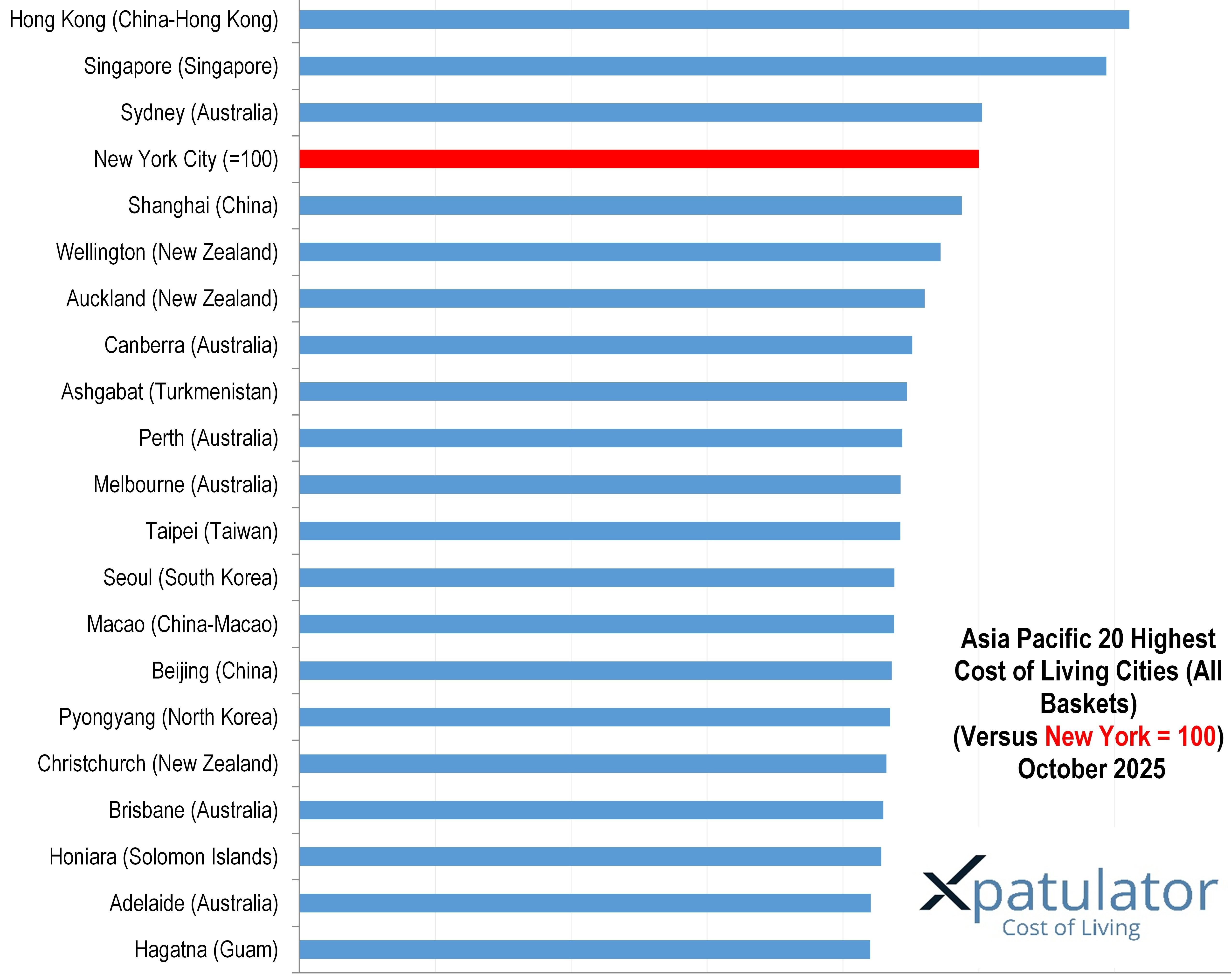

The Asia-Pacific region continues to dominate global cost-of-living rankings for expatriates, with Hong Kong and Singapore topping the list as the most expensive cities according to Xpatulator’s October 2025 survey. The high costs are fueled by a combination of limited housing, booming demand for international services, and heavy import reliance, particularly in Australia and New Zealand’s major cities. Meanwhile, unique economic pressures in places like Ashgabat and Pyongyang create inflated costs without the luxury amenities found elsewhere. For those considering relocation, the financial demands of life in Asia-Pacific’s leading cities now routinely exceed those in New York or Western Europe, forcing both expats and their employers to rethink global mobility strategies.

The Cost of Living in Asia-Pacific’s Most Expensive Cities

The Asia-Pacific region, home to some of the world’s fastest-growing economies and dynamic cities, has once again demonstrated its formidable cost of living for expatriates. According to Xpatulator’s latest quarterly survey, which benchmarks 780 locations worldwide using New York City as a baseline (index 100), Asia-Pacific continues to boast both the priciest and the most diverse cities in the global cost-of-living league table.

Hong Kong and Singapore

Hong Kong continues to be the most expensive city in Asia-Pacific, with a cost of living index of 122.1, significantly outstripping the regional and global average. Not far behind is Singapore at 118.7, cementing its reputation as a financial powerhouse with a high cost of living. The rationale behind these figures is clear. Both cities combine limited land with extraordinary demand, a potent cocktail for astronomical property prices. Add to this the unrelenting pressure on services, international schooling, healthcare, and imported goods—all of which are priced at a premium for foreign residents—and you have a near-perfect storm for cost escalation.

Hong Kong, in particular, is an extreme case of space scarcity. The world’s most vertical city is notorious for its micro-apartments costing more per square foot than a luxury home in the Home Counties. Singapore, while a touch more liveable and orderly, has imposed property cooling measures and taxation policies that ultimately do little to dent the broader inflationary pressures felt by expats, especially at international schools and private healthcare providers.

Australia and New Zealand

Beyond the big two, the cost of living picture shifts to the Antipodes, with Sydney (100.5), Wellington (94.4), Auckland (92), and a swathe of Australian cities, Canberra (90.2), Perth (88.7), Melbourne (88.5), Brisbane (85.9), Adelaide (84.1) dominating the top 20. Australia’s high standing in the ranking—Sydney is costlier than Shanghai (97.5), reflects a range of factors. Chief among them are high wages, a robust services sector, and persistent demand for well-located property, especially in its capital cities. But it’s not just property: the notorious “Australia Tax” on imports, a strong services economy, and the high cost of utilities and childcare all combine to create a surprisingly expensive environment for overseas professionals.

New Zealand’s twin entries—Wellington and Auckland—speak to the outsized influence of immigration and a chronic housing shortage, with local wages unable to keep up with surging costs in everything from groceries to fuel. For expats, the sticker shock can be acute, especially when relocating from lower-cost Asian cities.

China

Shanghai (97.5), Macao (87.5), and Beijing (87.2), are the standouts among Chinese cities, offering a cost profile that mixes international luxury with uniquely local challenges. Shanghai, now almost as expensive as Sydney, reflects the costs of a truly global city—premium housing, imported goods, and a penchant for luxury. Macao, famous for its casinos and a lifestyle geared towards high-rollers, brings its own inflationary pressures. Beijing’s high cost reflects the enduring premium on location, with diplomatic and international business quarters rivaling those of European capitals in expense.

Ashgabat and Pyongyang

Two of the most eyebrow-raising entries are Ashgabat (89.4) and Pyongyang (86.9). The cost of living in these capitals is less a function of luxury and more a consequence of acute supply constraints, import restrictions, and volatile currency regimes. In both cities, a lack of access to quality imported goods drives up prices for anything considered “foreign,” making life for expats not only expensive but often frustratingly difficult.

Rest of Asia-Pacific

The list rounds out with a variety of other contenders: Taipei (88.4), Seoul (87.6), and Honiara (Solomon Islands) at 85.6. In Taipei and Seoul, the driver is the high demand for urban real estate and services. In places like Honiara and Hagatna (Guam), it is the logistical cost of supplying remote island locations that inflates prices for virtually everything—making these some of the priciest postings for aid workers and government employees.

Implications for Global Mobility

For expatriates, the practical upshot of these rankings is sobering. Relocating to Hong Kong or Singapore now means budgeting for living costs more than 20% above those in New York, the de facto global standard. Even cities in Australia and New Zealand, long considered “soft landings” for international workers, present costs that will surprise anyone accustomed to life in Western Europe or North America.

Moreover, the rising cost of schooling, housing, and everyday necessities places increasing pressure on both individuals and the multinational organisations that deploy them. Many companies are rethinking their expat compensation packages, housing allowances, and even the desirability of certain postings. The days of generous hardship allowances and open-ended expense accounts are fading, replaced by a harder-nosed approach to global mobility.

Conclusion: A Region of Extremes

In summary, Asia-Pacific continues to see a wide range in global cost-of-living, with its leading cities demanding a premium for entry. For those seeking adventure or economic opportunity, the region remains as attractive as ever—but the price of admission is higher than ever before. In an era of growing mobility and intensifying global competition for talent, those high costs may yet become a defining challenge for the region’s future.

Use Xpatulator’s Cost of Living Calculators and Tools for informed decision-making about the cost of living and the salary / allowance / assignment package required to maintain the current standard of living.