The Cost of Living: Europe’s Most Expensive Cities in 2025

2025-10-01

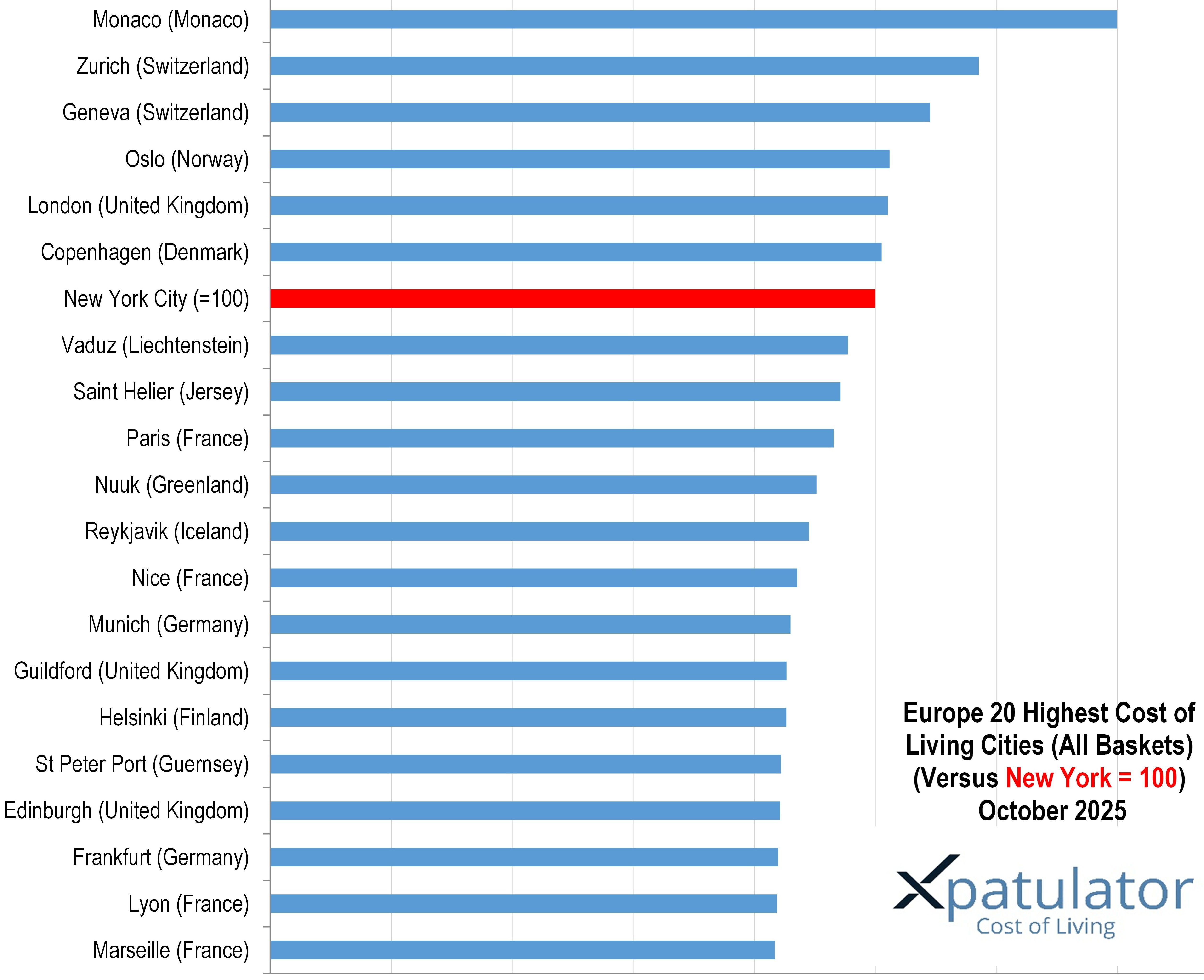

Xpatulator’s latest survey uncovers the top 20 most expensive cities in Europe for expatriates as of October 2025, with Monaco, Zurich, and Geneva leading the rankings. The analysis explores the reasons behind soaring living costs—ranging from housing shortages and tax policies to high local wages and isolation—and assesses the impact on expats considering relocation. While cities like London, Paris, and Copenhagen attract global talent and promise an exceptional quality of life, the financial burden is significant. Compared to the rest of the world, Europe’s allure comes at a steep price, making it essential for would-be expats to weigh both the costs and the benefits before making the leap.

Europe Expat Cost of Living in 2025

For decades, Europe has drawn expatriates in search of prosperity, culture and political stability. According to Xpatulator’s latest quarterly survey—benchmarking 780 locations globally with New York City set at 100, Europe hosts a wide range cost of living cities.

Monaco

Monaco is not only the most expensive city in Europe, it is the most expensive in the world with a cost of living index of 139.9. Monaco’s astronomical cost is driven not just by its postage-stamp size and staggering property prices, but by the relentless pursuit of luxury: everything from groceries to services is inflated by the tastes of its super-rich residents.

Swiss Precision, Swiss Prices

Zurich (117.1) and Geneva (109.1) follow, their indexes underlining Switzerland’s reputation for both order and opulence. Swiss cities consistently top the cost tables thanks to a toxic cocktail of sky-high rents, robust wages, and inflexible local markets. While quality of life is superb—clean streets, world-class infrastructure and a sense of civic order—there is no escaping the sting of everyday essentials. A decent flat in central Zurich costs as much as a London penthouse; a pint, an arm and a leg. Geneva’s international community—fueled by UN agencies and multinationals—has driven rents up further still. Frankly, unless your relocation package is suitably inflated, life in Swiss cities is not for the faint of wallet.

Scandinavia’s High Cost of Living

Scandinavia’s infamous costliness is well-represented. Oslo (102.3) and Copenhagen (101) are joined by Nuuk (90.3), Reykjavik (89), Helsinki (85.3), all underscoring the price of generous welfare states, high taxes, and isolated geographies. Denmark and Norway, in particular, layer on additional costs through VAT and “sin” taxes. For expats, the trade-off is obvious: exceptional public services and safety, offset by punishingly high grocery, alcohol, and transport bills. It is an expensive form of comfort—one you pay for in krone and kroner.

The UK: London and the Commuter Squeeze

London remains the UK’s costliest city for expats (102.1), sandwiched between Oslo and Copenhagen. Despite years of currency fluctuations and Brexit’s much-vaunted economic shockwaves, the capital’s housing shortage continues to keep rents and property prices elevated. It’s not just central London, either: Guildford (85.3), a popular commuter town in Surrey, creeps into the top 20, a telling indictment of the capital’s out-of-control sprawl and the overheated South-East property market. Both London and Guildford epitomise the paradox of British life—world-class culture and opportunity, if you can bear the rent.

France: A Tale of Two Cities—And More

Paris (93.1) continues to exert its gravitational pull, combining old-world glamour with modern-day sticker shock. Nice (87.1), Lyon (83.8), and Marseille (83.4) also make the top 20, reflecting a persistent urban/rural divide in France’s economic geography. In Paris, high demand, restrictive zoning, and the sheer weight of history keep rents and daily expenses eye-wateringly high. Meanwhile, Nice benefits (or suffers) from the Côte d’Azur’s appeal to the global elite, pushing up housing and service costs to near-Parisian levels.

Offshore Cost of Living

Saint Helier (Jersey, 94.2) and St Peter Port (Guernsey, 84.4) are small in population but high in cost. As offshore financial centres, they offer tax advantages—but living there is anything but cheap. These micro-economies import almost everything, and space is at a premium. The same logic holds in Nuuk (Greenland, 90.3), where geographical isolation and supply-chain costs drive up even the simplest of goods.

Germany

Munich (86) and Frankfurt (83.9) make Germany’s only appearances, reflecting both cities’ roles as economic powerhouses with high expat populations. The German cities offer exceptional infrastructure and stability, but not at the eye-watering levels seen in Switzerland or Scandinavia.

The Expat Calculation: Is Europe Worth It?

What does this mean for anyone eyeing a European move? The cold reality is that Europe’s most attractive cities are also, almost universally, its most expensive. A few factors dominate: restrictive housing markets, high wages, limited supply, and the cost of importing goods to small or isolated locations. For those with a generous expat package or well-heeled remote workers, the trade-offs may be worth it—top-tier public services, culture, and security. For the rest, the numbers are sobering.

Relative to other parts of the world, Europe’s high cost of living is driven more by housing and local services than by raw consumer goods. Expats should expect to pay a premium for location, quality of life, and stability. In the end, the question is not whether you can afford to live in Europe’s top cities—but whether you’re willing to.

Use Xpatulator’s Cost of Living Calculators and Tools for informed decision-making about the cost of living and the salary / allowance / assignment package required to maintain the current standard of living.